When President Trump abruptly announced 25 percent tariffs on Canada and Mexico on Feb. 1, a WhatsApp group for Canadian beauty startup founders sprung into action.

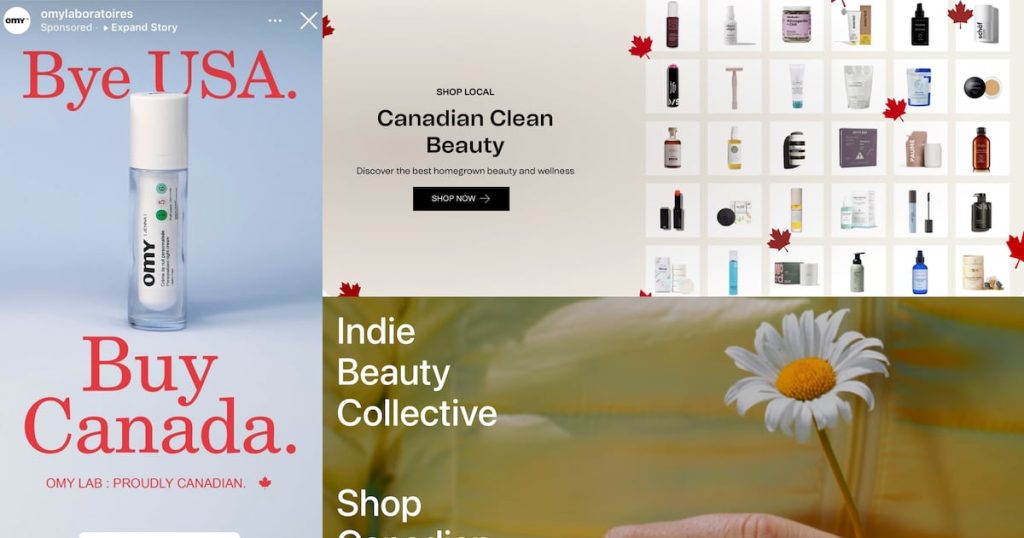

Within two days, they had formed the Shop Canadian Indie Beauty Collective, a website listing domestic offerings from sustainable body-care brand Everist, clean skincare label Graydon and Ayurvedic skincare collection Sahajan. The 20 brand founder members listing their labels on the site contributed funds to set up the collective’s website and hired a publicist to promote it within Canada.

“It happened with lightning speed,” said Lisa Mattan, the founder and CEO of Sahajan and a member of the collective. “It speaks to that Canadian hustle.”

Trump’s stated reason for the tariffs is an “extraordinary threat posed by illegal aliens and drugs,” but founders, retailers and investors are concerned about the potential of the tariffs to force them to choose between denting margins or raising prices when consumers are already concerned about inflation. Before the tariffs took hold on Tuesday, the nation’s homegrown beauty brands, who are heavily dependent on US exports, have been scrambling to send products to US warehouses. Grappling with the long-term implications of Canada’s role as an export-led startup hub, they’ve also joined influencers and retailers getting on board with “Buy Canadian” social posts and ads.

“The reaction of Canadians has been so aggressive,” said Jenn Harper, the founder and CEO of Canada-based Cheekbone Beauty, which has been posting Instagram content highlighting the fact that it is the only Canadian colour cosmetics brand at Sephora Canada, and resharing influencers’ Canadian beauty brand roundups. Sephora Canada itself has seen its Instagram comments fill with consumers asking for a curated list of Canadian brands to shop.

“I’ve never seen anything like it,” Harper added.

A Global Beauty Capital

The launch base for global powerhouse brands like MAC Cosmetics, Deciem, and Ilia Beauty, Canada has long been a thriving global beauty startup capital. For new beauty brands, export to the US has been a given, and is often baked into their business models from the beginning.

“We’re already international on day one. We have to control digital spend in two geographies out of the gates,” said Manica Blain, the founder of VC firm Top Knot Ventures, which invests in consumer DTC brands including Sahajan and Everist. This two-market mindset makes Canadian founders “incredibly scrappy,” Blain said.

The bulk of Sahajan’s sales, for one example, are split nearly 50-50 between Canada and the US, with only 2 percent coming from outside those two countries.

“It’s incredibly important to go to the US quickly,” said Mattam. Beyond the size of the market, the US is crucial for recognition by US-based press and influencers. That international positioning — also seen in global beauty startup capitals like Seoul — is what helps make Canada a “hub for innovation,” said Mattam.

Smaller indie brands with Canada-exclusive manufacturing will not be able to shift operations as quickly as major global conglomerates, say founders and investors. The extent of the impact is still to be determined, as questions like whether a de minimis exemption allowing tax-free orders up to $800 — which was briefly suspended, then reinstated for China (with a note that it will still eventually go into effect) — would apply to Canadian goods, or if tariffs would be applied to the wholesale or retail cost of goods, which has significant implications for margins.

The impact wouldn’t be limited to Canadian brands selling in the US, as possible retaliatory tariffs combined with consumer boycotts could dent US brands’ performance in Canada. That market has been a big opportunity for expansion in recent years — Canada reportedly contributed $2 billion out of Sephora’s $10 billion in North America revenue in 2023, according to industry sources. Sephora did not provide a confirmation.

Beauty Patriotism

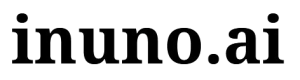

In response to the tariffs, the beauty industry has been tapping into “Buy Canadian” pride.

Sahajan, for example, has created several ads and social posts highlighting that it is a Canadian brand. One ad features the Canadian flag alongside founder Mattam stating, “It has never been more important to shop Canadian.” The cosmetics brand Nudestix, meanwhile, has been posting lists of Canadian beauty, fashion and home brands on its Instagram account and encouraging its audience to shop them.

“There is an interesting opportunity for Canadian brands to put up their hand, maybe louder than they ever had before, and say, ‘we’re Canadian,’” said Mattam.

Retailers have also gotten on board. The Detox Market’s Canadian homepage opens to a “Canadian clean beauty” banner linking to a curation of brands including body care brand Sidia, clean skincare label Three Ships and more.

But founders also want to ensure the US customer is not alienated. To keep prices steady, they have scrambled to move their products into US-based third-party warehouses before the tariffs take effect. “The last thing that you want to do is be hitting your customer with that huge price increase,” said Blain. Sahajan, for example, moved an estimated three months worth of product to the US in anticipation of tariffs.

These are short-term solutions, while the long term remains unclear. Canadian founders cast doubt on the idea that tariffs will spur a US-led manufacturing boom — a pipe dream when it comes to beauty.

“You’d be reverse-engineering a product and starting over.” said Sasha Plavsic, the founder of Ilia Beauty, which has some manufacturing in Canada along with multiple global locations including the US and Europe. The two-year average for product development, she pointed out, “is a very long process, and by that time, the trade war could be over.”

Even if these tensions cool in the coming months, the conversation has already shifted founders’ and investors’ mindsets in Canada when it comes to where to look for growth. Rather than focusing squarely on the US at launch, founders say they are likely to start looking at expansion to other markets more quickly from now on.

If tariffs remain at 25 percent, Canada’s startup scene is in for a rough year.

“This will kill small businesses, absolutely, 100 percent,” said Harper of Cheekbone Beauty. “This is doing nothing for the economy. It is just creating more inflation and making all of our goods, no matter who we are — in Canada or the US — just cost more.”