Health records companies are racing to weave artificial intelligence into multiple segments of their software, hoping that by streamlining clunky experiences they can attract clients and keep up with competitors doing the same.

Some of the largest EHR vendors, including Epic and Oracle, have announced or accelerated modernization efforts in recent months. The companies say they aim to increase the productivity of a healthcare system facing rising costs — while improving job satisfaction for doctors and nurses, increasing the quality of patient care and advancing the state of the art of medicine.

The shift represents a sea change for a software often cited by providers as a significant source of frustraction.

“Doctors are not looking for AI to act as a doctor, to step in their place,” said Leigh Burchell, chair of the Electronic Health Records Association. “They really want to take the things that are adminsitrative burdens, or that take them time after a visit to document, and get help with that. So those are really the areas where our members are most focused.”

Marrying medicine and technology

EHR software allows clinicians to access and update a patient’s complete medical history electronically, including diagnoses, lab results and medications. Healthcare providers in the U.S. were required to adopt EHRs more than one decade ago in order to continue receiving full funds from federal programs like Medicare and Medicaid. Use of the software spiked, with 78% of physicians and 96% of hospitals using an EHR in 2021, according to government data.

However, doctors often express annoyance with EHRs. The systems can be tricky to use, cluttered with pop-ups and screens and requiring significant time for clinicians to enter and find data. Another common criticism is that EHRs were designed more for billing purposes than for clinical decisionmaking. Many doctors say the systems distract from patient care as a result.

Major EHR vendors have long said they’re working to make their products simpler and easier to use. That crusade is being significantly accelerated by recent advances in AI: like generative AI, which can understand and create original text and images; ambient listening, which marries microphones and machine learning to produce transcripts of clinician-patient encounters in real time; and agentic AI, which can complete complex tasks largely without human oversight.

In the past, navigating EHRs required a lot of data entry and “persistent screen after screen navigation,” Girish Navani, the CEO of EHR vendor eClinicalWorks, said. “If you look at the last two years, the advent and the rapid rise of generative AI makes a lot of those paradigms obsolete.”

Epic, the largest EHR vendor in the U.S., has “been working to incorporate in particular generative AI across the software,” said Seth Howard, Epic’s executive vice president of research and development.

The Wisconsin-based company holds more than one-third of the hospital market, trailed by Oracle Health, at 22%, and Meditech, with 13%, according to health analytics company Definitive Healthcare.

More than 3,100 hospitals use Epic, the company says. And about two-thirds of its customer base are live with the vendor’s generative AI products, according to Howard. Those include algorithms that help doctors write notes and summarize patient information for clinicians prior to a visit.

Epic integrated ambient listening software from a startup called Abridge into its workflow last year, but is working to make its software compatible with more products that can transcribe patient visits in real time, Howard said. The company is also working to make its documentation tools multimodal, so they can understand videos, images and other types of information beyond text.

Over the past year, Epic has also started building a framework aroung agentic AI into its software, to see how digital assistants that can summarize information, interact with patients, schedule followups and more can work together, according to Howard.

Overall, Epic has 125 AI use cases either in development or live, he said.

“We are investing massively to ensure we rapidly innovate and get it right at the same time.”

Bharat Sutariya

Chief Health Officer, Oracle Health

Similarly, in October Oracle announced that it plans to release a new EHR platform this year that incorporates its clinical AI agent, voice-activated navigation and search capabilities. The clinical agent, which can record and transcribe patient visits and draft a note in the EHR for the clinician’s approval, is currently available for more than 30 medical specialties, the company said on Tuesday.

Bharat Sutariya, Oracle’s chief health officer, called the refresh “nothing short of a complete reinvention of the EHR.”

“We are investing massively to ensure we rapidly innovate and get it right at the same time,” he said.

Meanwhile Meditech and eClinicalWorks, a company that offers cloud-based EHR software currently in use at 70,000 care sites, are pursing a partnership approach.

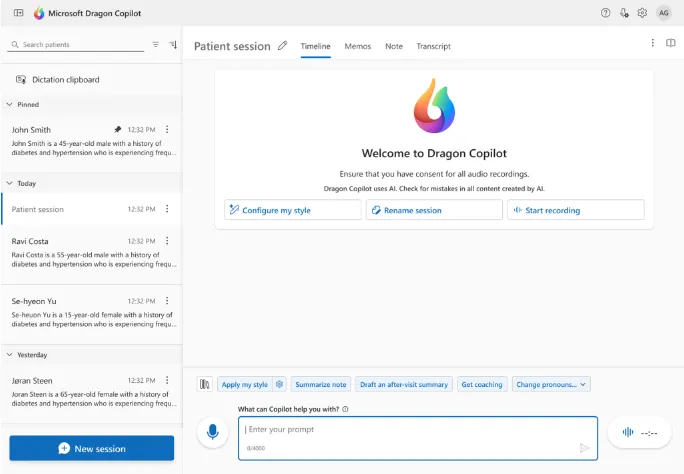

Meditech has long worked with Google to accelerate clinicians’ access to data and with Microsoft to automate scribing, including deploying Microsoft’s ambient listening and clinical documentation tools into its EHR.

Meditech also plans to include Microsoft’s latest clinical assistant as it rolls out this year, according to Rachel Wilkes, Meditech’s corporate lead for generative AI initiatives. A variety of other AI scribes are also available to Meditech’s customers through integrations with the company’s software, she said.

“We want to keep our existing customer base engaged,” Wilkes said. But “yes, we are looking to attract new customers as well by having a platform that is innovative, scalable, and a really good alternative to maybe other competitors that are out there.”

A user view of Dragon Copilot, Microsoft’s clinical assistant.

Courtesy of Microsoft

eClinicalWorks has also partnered with Microsoft to use machine learning to match patient records, and with a company called Healow to create an AI medical scribe and an AI contact center.

AI checks and balances

EHR vendors are remaking their software with AI despite dogged concerns about quality, privacy, bias and a lack of federal regulation around the technology.

Generative AI in particular is tricky to monitor. The models are known to hallucinate, or provide factually incorrect or irrelevant answers, or omit information altogether. Their performance can also degrade over time, in a phenomenon called model drift.

Still, records companies say that they, along with their clients, are carefully supervising AI to make sure they’re not making up any information — or leaving anything out.

Leaders with eClinicalWorks, Meditech and Epic said they’ve invested heavily in risk management and have stood up stringent guardrails, including ongoing assessment by clinicians.

There should always be a human in the loop when it comes to ambient documentation and generative AI products, said Meditech’s Wilkes.

Meditech also includes disclaimer language on any records created by AI, sharing that it was created by an algorithm and reviewed by medical staff. The company is working to put more formal citations into the workflow to clarify what’s generated and where the model pulled relevant information from, Wilkes said.

Epic applies the same principles to ensuring AI quality as it does to any other software to make sure it works well and isn’t causing harm, according to Howard.

But “the techniques you might use to understand, ‘is it working well?’ are different,” Howard said.

Still, despite concerns with the models, hospital customers are full steam ahead on adoption, vendors say. According to a survey from HIMSS conducted in the fall, 86% of respondents already leverage AI in their medical organizations, mostly for administrative tasks, though there’s growing interest in more clinical use cases.

“Our customers are very warm to it. More warm over the past 12 months,” said Wilkes. “We’ve gone from doing a lot of education about the impact, to — now the question we’re getting is, ‘When? When can I get it? How much is it going to cost? What’s the plan?’.”

“There’s always going to be the early adopters, the mid adopters and the lagging adopters of technology. It’s happened with smartphones, it happened with color TV, it’s happened with every product,” said eClinicalWorks’ Navani. “All I can tell you today is we are seeing incredible multiples of customers who you would call early adopters.”

But “this is not just being done because modern is new and it’s good,” Navani continued. “It’s got a clear efficiency benefit written all over it. That’s driving the change.”