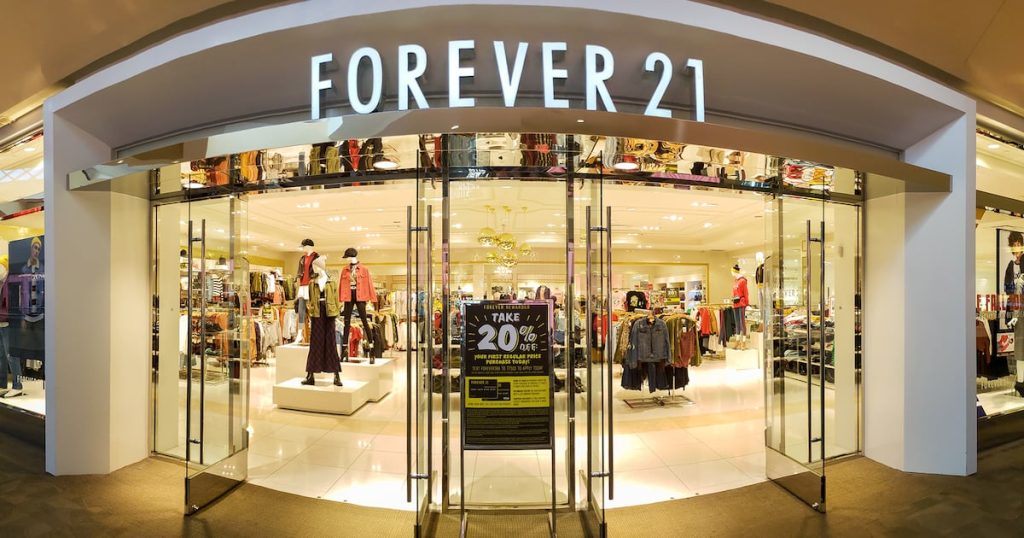

If you can’t beat them join them. That’s the strategy behind saving the Forever 21 name as the last remaining stores are shuttered and the brand pursues a model that is similar to its online competitors.

US bankruptcy judge Mary Walrath gave the company temporary permission on Tuesday to start going-out-of business sales at all of its 354 stores while managers try to find a last-second rescuer for part of the 41-year-old clothing chain.

Forever 21 has “had advanced discussions with third parties” about rescuing part of the chain, company attorney Andrew L. Magaziner said during the court hearing. The situation “remains fluid.”

Since the 1980s, Forever 21 stores have attracted droves of young women by selling low-cost, trendy clothing. But the company was undone by the rising cost of inventory and wages and competition from online retailers, like Temu and Shein that can skirt import duties and tariffs by shipping goods directly to consumers, the company said in court papers.

It’s the company’s second bankruptcy and the latest brick-and-mortar store to fold in a wave of closures over the past decade or so. The pace of failures picked up during the pandemic as malls closed, and buyers turned to online sellers during lockdown.

Should it fail to find a partner to rescue some of its stores, Forever 21 would rely on shipping goods directly from overseas factories to consumers and to other retail outlets, according to a person familiar with the company’s plans. Authentic Brands Group LLC, the apparel and lifestyle label empire which owns the Forever 21 name and other intellectual property, has successfully tested the factory-to-retailer model outside the US, the person said.

Last year just 11 percent of Forever 21’s sales were online, according to court papers. The company also plans to sell Forever 21 apparel in partner stores, including in JCPenney where such an arrangement is already underway.

Currently, Forever 21 uses a traditional structure in which designers and other vendors in the US acquire merchandise from overseas factories, mainly in China, Korea and Hong Kong, according to court records. That material is then sent to Forever 21 stores and warehouses, which requires the company to pay duties and tariffs, the records show.

Authentic Brands will continue to own the IP and may license the brand to other operators, according to a statement Sunday. Forever 21’s locations outside of the US are operated by other licensees and aren’t included in the bankruptcy.

The company plans to finish shutting its stores by the end of April, Magaziner said in court on Tuesday. If a buyer appears for some of the stores, the company would adjust its strategy, he told Walrath.

A joint venture of Hilco, Gordon Brothers Retail Partners LLC and SB360 Capital Partners is working on the liquidation.

The court also approved a request to use secured lenders’ cash to fund the bankruptcy cases and payrolls. The company entered the Chapter 11 with about $47.2 million bank cash, according to a budget disclosed in the court papers.

It’s the clothing brand’s second stint with bankruptcy. Its first in 2019 was rife with fighting, left creditors little recovery and resulted in the closing of hundreds of locations it had during its heyday.

A group of buyers — including Simon Property Group Inc., Brookfield Corp. and Authentic Brands — teamed up to buy Forever 21 out of bankruptcy through a venture called Sparc Group. That group partnered with Shein in 2023 as Forever 21 attempted to solve some of its operational issues.

A few months ago, US retail group JCPenney acquired Sparc, forming Catalyst Brands. The deal saw its previous shareholders maintain minority stakes in the company. At the time of the merger, Catalyst said it was exploring strategic options for the operations of Forever 21.

The case is F21 OpCo, LLC, 25-10469, US Bankruptcy Court for the District of Delaware.

By Dorothy Ma, Steven Church and Eliza Ronalds-Hannon

Learn more:

The Debrief | Is Forever 21 Shein’s Biggest Victim Yet?

Retail editor Cathaleen Chen joins Brian Baskin and Sheena Butler-Young to discuss the fall of Forever 21, the future of fast fashion and why affordability alone isn’t enough to win consumers.