The blistering rally in Hims & Hers Health Inc. that’s captivated meme-stock traders has ground to a halt, setting up a pivotal test when the telehealth company reports earnings after the market closes Monday.

Regulators on Friday raised a roadblock to the company’s business of selling cheaper copies of branded anti-obesity drugs like Novo Nordisk A/S’s Wegovy. Hims & Hers shares have soared 458 percent since it announced the move into weight-loss treatments in December 2023.

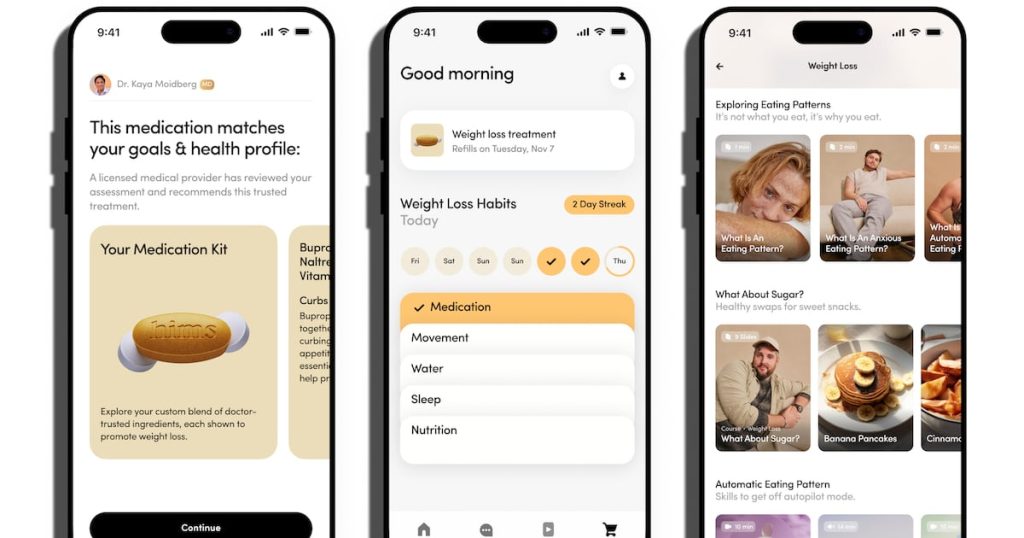

The company has said its personalisation strategy — to compound drugs based on an individual’s need — will enable it to continue selling the products. Investors will need to be convinced that that will pass muster legally, said Michael Cherny, an analyst at Leerink Partners.

“We do see potential for a reset in the stock after it had been clearly driven up by excitement over the broader weight loss opportunity,” Cherny wrote in a report Friday. He has the equivalent of a hold rating on the stock with a price target of $24, more than 50 percent below where it ended last week.

Companies with patented drugs like Novo typically enjoy years of exclusivity before cheaper copies flood the market and drive prices down. But Novo has been unable to meet the demand for Wegovy and Ozempic in the US, clearing the way for copycat versions.

On Friday, the Food and Drug Administration declared the shortage over, sending Hims & Hers shares down 26 percent. The ruling means compounding pharmacies no longer have permission to make exact copies of Novo’s drugs as they did during the shortage.

Retail traders’ interest in Hims & Hers picked up this year after the company rolled out an ad, later shown on the Super Bowl, that touted its weight-loss medications while railing against the pitfalls of the US health system.

In moves reminiscent of the meme-stock days of GameStop Corp. and AMC Entertainment Holdings Inc., retail traders have been faithful buyers of the stock since the commercial debuted Jan. 28. Investors regularly cheered on the stock on popular day-trader chatrooms like the WallStreetBets community on Reddit as well as the Stocktwits platform.

Bears, though, have been steadily increasing bets against the stock: Shares out on loan — a proxy for trades by short sellers — has risen to 33 percent of the stock available for trading from 14 percent at the beginning of October, data from analytics firm S3 Partners show.

Traders are gearing up for a big move on the earnings news, with options implying a 24.1 percent swing in either direction in the session after the release. That’s far above the 10.8 percent average move over the past two years and the biggest since February last year.

Options costs have been surging since mid-January, with one-month implied volatility climbing from 81 percent to reach 144 percent on Feb. 13. That was the highest level since February 2021, shortly after the stock started trading.

Investors will also be particularly interested in whether the stock’s 104 percent rally year-to-date can be backed up by a better-than-expected earnings outlook. The bar for the 2025 outlook “is clearly very high,” said Truist analyst Jailendra Singh who sees the company issuing guidance “well above consensus.”

Meanwhile, average estimates project the company will post a 929 percent jump in fourth-quarter profit, with sales growth of about 91 percent. The risk of a disappointment, however, is high: The stock is trading at 45 times estimated earnings, higher than that of obesity drugmaker Eli Lilly & Co. at 37.

“Their growth rate trajectory is enormous,” said Bob Lang, the founder of Explosive Options. “So you’d almost have justification for the stock going parabolic from a fundamental view, but if it starts to slow down, the stock is going to come tumbling down really fast.”

Even with Friday’s reset, Wall Street analysts remain largely cautious on the stock — more than half of the 15 analysts tracked by Bloomberg recommending investors to hold or sell shares. Analysts on average see the shares dropping to $38 in the next 12 months, a 23 percent decline from Friday.

By Angel Adegbesan

Learn more:

Hims Drops Most Ever as Amazon Enters Hair-Loss Drug Market

The telehealth company’s shares plummeted 18 percent after Amazon announced plans to market hair loss treatments, a key part of Hims’ business.