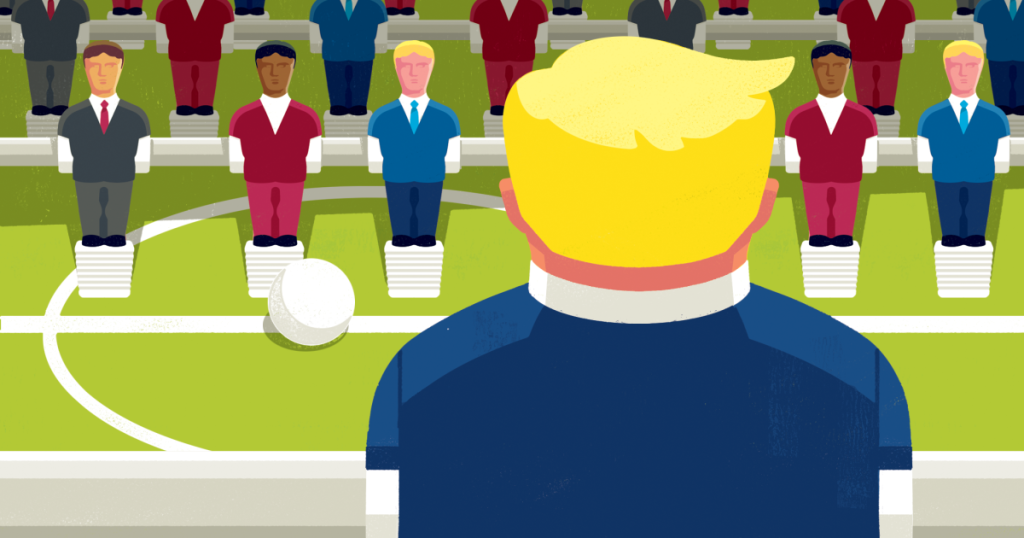

In many ways, Donald Trump’s election to a second term as U.S. president is a story of economic dissatisfaction. For the first time in decades, the Democratic candidate received more support from the richest Americans than from the poorest. In 2020, most voters from households earning less than $50,000 a year opted for the Democrat, Joe Biden; in 2024, they favored the Republican, Trump. Those making more than $100,000 a year, meanwhile, were more likely to vote for Kamala Harris than for Trump. Declining support for the Democratic Party among working-class voters reflects a deep disenchantment with an economic system that, under administrations led by presidents of both parties, has concentrated wealth at the very top, enabled the growth of the financial sector at the expense of the rest of the economy, trapped people in cycles of debt, and deprioritized the well-being of millions of Americans.

Although his promises of economic relief tapped into a real problem, Trump is offering the wrong solutions. The policies he supports will not meaningfully change the unpopular economic model that produced the wave of anger he rode to victory. Instead, his proposed tariffs are likely to increase the cost of living and deliver few benefits for the American working class. If his administration goes through with its plans to dramatically reduce the size of the public sector, the U.S. government will lose much of its ability to deliver on big projects for years to come. And his mercantilist policies could both incite economic instability abroad and shrink the United States’ capacity for economic leadership.

But the revival of American economic nationalism need not spell the end of a global pursuit of more inclusive, sustainable growth. Countries such as Brazil, South Africa, and the United Kingdom are already experimenting with ambitious economic agendas at home, and proposals abound to make multilateral institutions more equitable and effective. A retreating United States may not be in any position to lead this reform effort. Yet its absence will leave a space that other countries could fill. New ideas could get a hearing, new trade relationships could emerge, and new power dynamics could create opportunities to build momentum toward broader change.

There is no guarantee that the coming rebalancing of the global order will lead to a more equitable and sustainable future. To move toward an economic system with affordable access to finance, fair governance of global trade, and support for all countries to invest in and benefit from the growth of green industries, governments must be willing to take bold steps. They must learn the right lessons from Trump’s victory—that the current economic model is failing and that the incremental policies Biden and Harris offered would not have saved it. But neither will the protectionist agenda Trump has proposed. Transformative change requires an alternative vision, one that prioritizes the well-being of people and the health of the planet.

MISSED OPPORTUNITY

Harris’s loss to Trump reflects Washington’s inability to fix the serious flaws in the prevailing economic model. Decades of economic policies that weakened labor laws, underinvested in education and health care, and bolstered the financial services sector have perpetuated structural inequalities in the United States. Biden arguably did more than most of his recent predecessors to address stagnant wages and a high cost of living, including bringing down inflation from 9.1 percent in June 2022 to 2.4 percent in September 2024 and signing an executive order to ensure a $15 per hour minimum wage for federal government employees and contractors. But like those predecessors, he left unresolved many underlying problems: wealth and income inequality, high rates of personal debt, uneven access to high-quality education and health care, inadequate labor laws, and the financial sector’s expanding share of and influence over the economy.

The issue is not poor economic performance. Average GDP growth under Biden was approximately the same as it was during Trump’s first term, and the United States’ pandemic recovery was the strongest in the G-7. The U.S. economy added almost 15 million jobs between January 2021 and January 2024; in the first three years of Trump’s administration, by contrast, fewer than seven million jobs were added.

But critically, economic growth has not translated to improved circumstances for many Americans. According to the latest census data, 36.8 million people—11 percent of the U.S. population—lived in poverty in 2023. As of June 2023, 43.6 million Americans held an average student loan debt of approximately $38,000 per borrower. Americans’ economic frustrations have been compounded by inflation, which increased during the first two years of Biden’s administration to a peak above nine percent in June 2022. When supply bottlenecks emerged because of the pandemic and Russia’s invasion of Ukraine, companies jacked up prices for food, energy, and other goods, worsening inflation. And perhaps most important, wage growth has stagnated: average weekly earnings rose under Biden but not enough to keep up with inflation. Many working-class Americans therefore had little reason to think the Biden administration’s policies left them better off—and much reason to doubt Harris’s promises to create an economy that would work for them.

This disconnect between growth and material benefit for the working class is the product of decades of U.S. policy. For the past half century, Democrats have supported measures that increased the influence of the financial sector in the U.S. economy, weakened worker bargaining power, and suppressed wages. The Carter administration in the 1970s deregulated the trucking and airline industries, and President Bill Clinton signed the 1999 Gramm-Leach-Bliley Act and the 2000 Commodities Futures Modernization Act, which, among other things, facilitated the concentration in and deregulation of the U.S. financial sector that contributed to the financial crisis of 2008. In the 1990s, the party backed U.S. entry to the North American Free Trade Agreement and granted China “permanent normal trade relations” status, both of which may have contributed to job loss and downward wage pressure.

Republican politicians supported these policies, too, and often took more direct aim at curtailing labor rights. They have opposed increases to the federal minimum wage, made budget cuts and appointments that weakened the National Labor Relations Board, sought to abolish collective bargaining rights for public employees at the state level, and pushed for so-called right-to-work laws at the state level that forbid contracts between labor unions and employers that require employees to join the union in their workplace. In part because of these pressures, union membership in the United States has steadily declined from more than 30 percent in the 1950s to around ten percent today. Yet according to a 2020 Gallup poll, 65 percent of Americans approve of labor unions, and according to a 2017 study, nearly 50 percent of nonunion workers say they would join a union if given the choice.

Meanwhile, structural forces that put shareholder interests above the public interest have further disenfranchised working-class Americans. Share buybacks (in which firms repurchase their own stocks to inflate stock prices) have risen in the United States, totaling over $4 trillion in the last decade and $795 billion in 2023 alone. Pharmaceutical and manufacturing companies spend more on share buybacks than on worker training, infrastructure and technology upgrades, or research and development. Financial markets have become increasingly decoupled from the real economy, with investments often concentrated in financial, insurance, and real estate firms. Harris’s campaign was, if anything, more friendly to Wall Street than Biden’s had been: the 28 percent capital gains tax Harris proposed for Americans making more than $1 million a year was far lower than the nearly 40 percent tax Biden proposed in 2020.

To build an economy that

works for all, public investment is critical.

The Biden administration’s industrial policy did notch notable successes, but it was never going to be a panacea for the economic hardships of the majority of the American working population. The 2022 Inflation Reduction Act (IRA), for example, generated more than 330,000 clean energy jobs and more than $265 billion in new clean energy investments within just two years. Provisions for workers and communities were also embedded in Biden’s strategy: the 2022 CHIPS and Science Act (for which I was an adviser) placed conditions on private-sector access to CHIPS funds, including wage requirements and guaranteed access to benefits such as affordable childcare. But the reach of these policies was limited. They were designed to boost production and create new jobs with better benefits only in certain sectors, not across the whole economy. By restricting the scope of its industrial agenda, the Biden administration missed opportunities to speed up the pace of change and to address structural economic weaknesses.

Even in the sectors covered by its policies, the Biden administration did not go far enough to support communities and labor. The minimum wage standards required of firms receiving CHIPS funding, for example, could have been applied to all categories of workers, not just to laborers and mechanics. Instead of asking only for commitments to community engagement and investment as part of the bid evaluation criteria, the government could have required recipient firms to enter agreements to give community stakeholders a seat at the bargaining table. It could also have required companies to give worker representatives positions on their boards and to sign deals protecting the right of workers to organize. Investment in state and local government capacity, too, could have helped get money moving faster to new projects, such as the construction of new semiconductor fabrication plants and programs for training and hiring local workers.

An effective industrial strategy needs to be about shaping good job opportunities for workers as much as it is about shaping market opportunities for companies. The United Automobile Workers Union strikes in 2023 underscored the risks of focusing on the latter at the expense of the former. Ahead of the strike, the “big three” U.S. automobile companies all sought tax credits and low-interest loans under the IRA, in many cases for battery-producing facilities that would not be unionized and would pay wages well below industry standards. The legislation was creating new jobs, but as the strikers made clear, the quality of those jobs remained below what was acceptable to American workers. In the end, not enough people saw the Biden administration’s industrial strategy produce attractive job opportunities—or saw it advance other goals they cared about. In addition to assisting a green transition, for example, the strategy could have included measures to improve access to healthy and affordable food or to lower the costs of prescription drugs and other forms of health care. Part of the Democrats’ problem was their messaging, but they also failed to take bold enough steps to overhaul the underlying economic model that is failing to serve the interests of most Americans.

ONE STEP FORWARD, TWO STEPS BACK?

Trump, in his second term, is unlikely to resolve the problems that fueled voter dissatisfaction with the Biden administration and created a receptive audience for his populist appeals. His team has put forward not a comprehensive economic plan but a grab bag of proposals for tax cuts, tariffs, and financial deregulation. It has indicated no clear direction for the future of U.S. industrial strategy. And the economic nationalism Trump seems to favor could exacerbate problems at home and stir up economic trouble across the world.

If the new president pursues a strongly protectionist strategy based on tariffs, American consumers would likely suffer. The Biden administration hiked up certain tariffs, too, raising levies on Chinese goods, including electric vehicles, solar cells, and certain steel and aluminum products. But Trump’s more sweeping mercantilist policies include a proposed tariff of 60 percent on all Chinese goods, which make up over 16 percent of total goods imported to the United States, and a tariff of ten to 20 percent on all other foreign goods. Such trade barriers could easily cause U.S. inflation and interest rates to shoot up. American consumers would bear the burden of rising prices: a Center for American Progress Action Fund study estimated that a universal ten percent tariff would lead to a cost increase of $1,500 per person per year. Furthermore, there is, at best, only mixed evidence that tariffs would boost U.S. manufacturing jobs. If domestic alternatives to foreign-made production inputs are not readily available, U.S. companies may pass the increased costs of imported materials on to consumers.

A few members of the Trump camp—such as Secretary of State Marco Rubio and to a lesser degree Vice President JD Vance—have pushed for investment-led growth rather than simply building trade walls. Rubio, in particular, favors a strategy based on incentivizing domestic production. He has criticized the CHIPS Act and the IRA for being overly expensive, top-down, and likely to create market inefficiencies. But he has also advocated for government support across the entire supply chain, “from the mine to the factory.” If an approach like Rubio’s takes hold in the Trump administration, the result could be an industrial policy that, compared with its Democratic predecessor’s, places a similar emphasis on investment but more emphasis on deregulation and less on the role of the government in shaping the direction of growth.

On specific elements of Biden’s industrial strategy, some continuity is likely under Trump. The new administration may strip away elements such as clean energy tax incentives, but it is unlikely to repeal the IRA entirely because the act has benefited Republican districts. Continuing to prioritize domestic semiconductor development also fits in neatly with Trump’s “America first” agenda. And state intervention in the economy has long been a normal feature of both parties’ policy approaches. If Trump decides to commit to industrial strategy—a possibility that should not be overlooked—he should try to find ways to make the policy work for American workers. Linking industrial strategy to climate targets may be off the table, but the Trump administration could tie subsidies and other measures that benefit firms to goals that benefit people, such as ensuring a supply of well-paying jobs and making food and health care accessible and affordable across the country.

Steps the Trump administration could take to reduce the size of the federal government, however, could undermine Washington’s capacity to pursue ambitious objectives—not just over the next four years but for a long time after. Trump initially tapped the businessmen Elon Musk and Vivek Ramaswamy to lead a new body, the Department of Government Efficiency, that he says will aim to “dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure federal agencies.” This approach erroneously assumes that the government should be run like a business; it fails to recognize that the role of the state is not just to administer services and fix market failures but also to design and deploy policies that shape markets to deliver public benefits. The success of Musk’s own companies is a result of state support: Tesla has received at least $4.9 billion in government subsidies, and SpaceX relies heavily on NASA contracts and technology and staff that were developed and trained at NASA. Down the line, U.S. economic health and progress toward bold goals, such as the transition to clean energy, will require a highly agile state that can shape markets, direct growth, and make deals with the private sector that create public, not just private, value.

To build an economy that works for all, public investment is critical. Private investment in domestic production will not happen without government investment, and businesses left to their own devices will not necessarily invest in ways that benefit working people. Mission-oriented industrial policy can direct private investment toward resolving real problems, such as increasing access to healthy food and reducing greenhouse gas emissions, aligning social and environmental goals with domestic and global market opportunities. The government can spur investment and innovation across sectors, promoting growth that is inclusive and sustainable. This approach can yield far better outcomes than the typical industrial strategy, which is limited to picking certain sectors to support and is therefore more susceptible to capture by private interests and less likely to prompt economy-wide transformation. The Biden administration’s strategy fell short in this regard, and although the Trump administration has an opportunity to do better, its early rhetoric suggests that it will likewise fall short.

LOOKING FOR LEADERS

Trump’s economic nationalism could create trouble for the world, too. High U.S. tariffs could provoke price instability and trade wars as other countries are hit hard in a global economy dependent on exports to the United States. Many countries are pursuing their own industrial strategies, motivated by protectionism, geostrategic interests, and a recognition that the low-carbon transition offers a first-mover advantage to those that build up their green industries now. If Trump rolls back measures to secure U.S. dominance in green technology markets, other countries may be able to build their own market share. But at least in the short term, U.S. tariffs and the retaliatory measures they will invite are likely to cause problems, including supply chain disruptions and higher prices for people both in the United States and across much of the world.

If Trump also pulls away from engagement with international institutions, the United States will leave a hole in global governance. During his first administration, Trump cut U.S. funding to the UN, which in 2023 accounted for 22 percent of the UN’s budget. He pulled out of the UN Human Rights Council and UNESCO, too, and threatened to quit the World Health Organization and the World Trade Organization. The Biden administration did not have a stellar record on multilateralism, either: it remained behind on U.S. payments to the UN and has continued Trump’s policy of blocking appointments to the WTO Appellate Body. And the United States’ retreat has come amid a broader weakening of trust in international institutions to facilitate meaningful cooperation on key issues.

To address climate change, water scarcity, and global inequalities, that trend needs to turn around. But current multilateral institutions will require substantial retooling first. Reforms such as the Bridgetown Initiative, led by Barbados Prime Minister Mia Mottley, are needed to fix an international financial system that denies many countries access to affordable financing for green projects. The initiative includes measures to provide emergency liquidity, reduce debt burdens, and scale up development finance, all in service of sustainable growth and resilient societies. Existing environmental conventions, too, should treat critical natural resources as global common goods—in the case of water, for instance, by adopting measurable goals for stabilizing the water cycle.

This moment is a chance to finally retire a failed economic model.

Updated global governance structures are also necessary to enable all countries, not just wealthy ones, to pursue green industrial strategies, to coordinate their policies, and to resolve associated trade disputes. WTO rules, for example, must be reformed so that they do not inhibit member countries’ green policies or disadvantage lower-income countries. A new facility within the WTO could also help ensure that individual members’ industrial strategies do not undermine shared policy goals. The EU’s Carbon Border Adjustment Mechanism, for instance, is a valuable policy that levies a carbon tariff on imported goods in order to prevent carbon pricing within the EU from simply pushing carbon-intensive production to non-EU countries. But the tariff has also harmed the economies of countries that export to the EU. A dedicated WTO facility could have provided a forum for addressing those concerns. In this case, agreements for the EU to provide financial and technical support to help low- and middle-income countries improve production standards could have reduced the negative effects of EU policies on their economies.

Pushing these reforms past the finish line will require leadership. A United States that eschews multilateralism is unlikely to fill that role, and neither is the European Union. European growth and productivity are lagging, and populist leaders in Hungary, Italy, the Netherlands, and elsewhere are making collective EU action more difficult. Germany’s economy shrank this year, and political infighting has prevented action to address the problem. Protests in France have shown that the country’s working class—similar to that of the United States—is not seeing the transition to a green economy as an engine for better jobs. All this spells trouble for the EU’s green industrial strategy, not to mention its global economic influence. In Latin America, for example, the EU is struggling to keep pace with China in the competition for trade and investment deals.

But as the United States’ and the EU’s international presence ebbs, the BRICS bloc—the grouping whose earliest members were Brazil, Russia, India, China, and South Africa and now include Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates—is likely to gain influence. BRICS has already expanded in size and scope over the last two decades, now representing more than a third of the global economy and half the world’s population, and it aims to serve as a counterweight to the West in global institutions. And G-20 leadership recently passed from one founding BRICS member, Brazil, to another, South Africa.

Even amid the economic instability that the Trump administration could bring, as the center of gravity of international governance shifts, opportunities to reshape global norms and build new forms of collaboration could open up. South Africa, for example, has announced the theme of its G-20 presidency to be “solidarity, equality, and sustainability,” and in practice, it could use its term to push for more equitable financial policies and trade rules. With support from other G-20 and BRICS members, South Africa could advance reforms to global financial structures that make it possible to tackle the debt crisis that has engulfed many low- and middle-income countries. Without such reform, unmanageable debt will continue to impede these countries from investing in domestic green industrial strategies or in other measures to prevent and respond to climate, health, and other emergencies.

New trade relationships that are less dependent on the U.S. market may emerge, too. If countries with economic clout, including Brazil and South Africa, decide to treat Washington’s protectionist turn as an opportunity not only to secure market access and supply chain resilience but also to embed climate and worker protections in new deals, the proliferation of non-U.S.-centric trade activity could recalibrate the global trade system. This direction is far from assured, but neither is a planet-wide retreat into nationalistic trenches. The drive for novel forms of collaboration can end up serving social and environmental, as well as economic, interests.

One BRICS member, Brazil, is advancing an industrial strategy (which I contributed to) that takes a mission-driven approach and can offer lessons for other countries. Oriented around six goals related to food security, health, sustainable and livable cities, digital transformation, the energy transition, and defense, it aims to catalyze investment, stimulate productive and technological development, and increase global market access, all while improving people’s daily lives. This approach is an improvement on the traditional industrial strategy of providing sector-specific support, which is prone to capture by private interests. But it remains to be seen whether Brazil’s strategy, which was rolled out in January 2024 and is scheduled to run until 2033, will live up to its promise to transform the country’s economy, and succeed where the United States’ strategy failed in distributing benefits to the least advantaged segments of the population.

In addition to Luiz Inácio Lula da Silva in Brazil, leaders such as Keir Starmer in the United Kingdom, Pedro Sánchez in Spain, and Cyril Ramaphosa in South Africa have made promises to put people and the planet at the heart of their national economic policies. Such leaders now need to learn from the Biden administration’s shortcomings. They should reject the false dichotomy between economic prosperity and environmental sustainability, develop strong policies to prevent inequality rather than relying on redistribution to fix problems after the fact, and form collaborative, reciprocal relationships with companies and trade unions to ensure that their economies grow in a way that is inclusive and equitable. If they succeed at home, they can then build momentum toward global financial and trade policies that enable other countries to follow a similar path.

A TIME FOR AMBITION

The current juncture carries great risk. It is all too easy to predict a scenario in which the mercantilist turn of a few major players pushes the world economy into a downward spiral of retaliatory trade measures, a rejection of multilateral institutions, and a retreat from global cooperation to tackle global crises. This outcome would produce very few winners, and it would put durable solutions to shared problems even further out of reach.

But this moment also provides a chance to finally retire the failed economic model that has privileged private over public value creation and replace it with a more sustainable and equitable global economic order. This recalibration may seem to rest on a set of slim hopes. Leaders must advance a bold vision to restructure international finance and trade and be willing to challenge vested interests in the process. They must form new domestic alliances—resetting the relationships among governments, companies, and unions—and foreign ones, seeking out like-minded countries to make planet-wide reform a viable prospect. And they must convince their constituents that this project will yield benefits for all. None of this will be simple, but it will not be impossible. In the current period of flux, the future is up for grabs.

As Brazil, South Africa, the United Kingdom, and other major economies consider how to proceed, Harris’s loss to Trump is a warning. The U.S. example should not inspire a shift toward insular economic policies and away from government investment in social welfare and climate action; instead, it should clarify the danger of insufficient ambition. The current economic order neglects the interests of people and the planet, and the world needs a system that will serve both. Achieving that change will require more than tinkering at the margins—it demands a deep restructuring of how economies work and whom they benefit.

Loading…