MANILA, Philippines — The local bourse slid by more than 1 percent on Thursday following news of the United States’ reciprocal tariffs on around 60 countries.

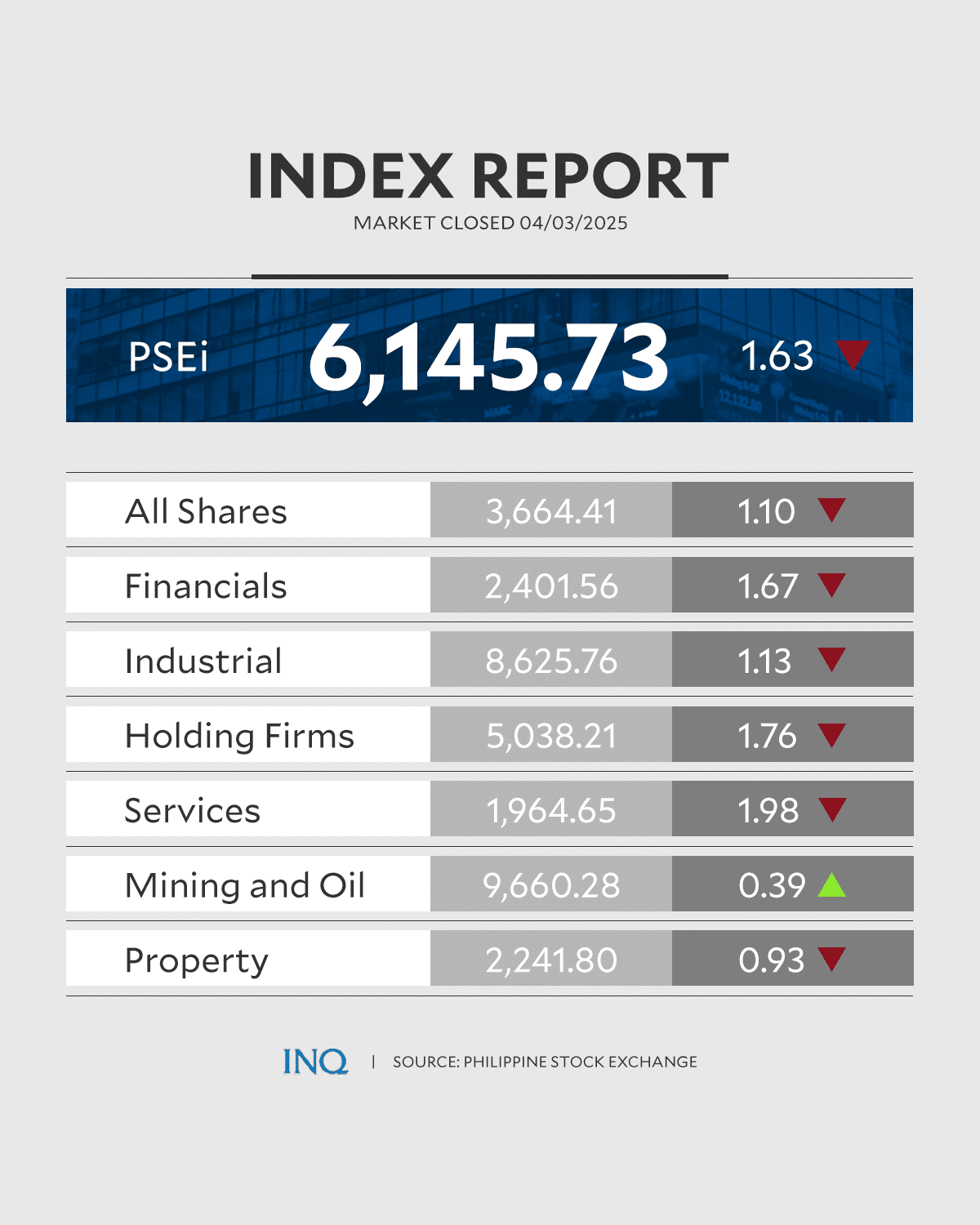

By the closing bell, the Philippine Stock Exchange Index (PSEi) fell by 1.63 percent, or 101.95 points, to 6,145.73.

The broader All Shares Index lost 1.1 percent, or 40.71 points, to 3,664.41.

Services firms saw the steepest decline at 1.98 percent, followed by the conglomerates at 1.76 percent.

Meanwhile, shares tumbled in Europe and Asia and US futures tumbled Thursday following US President Donald Trump ’s announcement of big increases in tariffs on imports of goods from around the world.

The double-digit tariff hikes sent shivers across world markets, as economists warned it raises the risk of recession.

The future for the S&P 500 dropped 3.1 percent while that for the Dow Jones Industrial Average lost 2.6 percent, auguring potential losses when US markets reopen on Thursday.

Germany’s DAX fell 1.7 percent to 21,998.48, while the CAC 40 in Paris lost 1.8 percent to 7,716.66. Britain’s FTSE 100 shed 1.2 percent to 8,506.44.

Asian markets take hits

In Asian trading, Tokyo’s Nikkei 225 index dipped 4 percent briefly, with automakers and banks taking big hits. It closed down 2.8 percent at 34,735.93.

Mitsubishi UFJ Financial Group’s shares plunged 7.2 percent as the potential impact of the 24-percent tariffs on the export-dependent Japanese economy dashed expectations that the central bank will keep raising interest rates. Mizuho Financial Group skidded 8 percent.

Sony Corp.’s stocks sank 4.8 percent and Toyota Motor Corp. gave up 5.2 percent.

Japan’s yen gained , with the US dollar falling to 147.42 Japanese yen from 149.28 yen. The euro rose to $1.0952 from $1.0855.

In South Korea, which was hit with a 25-percent tariff, the benchmark Kospi fell 1.1 percent to 2,486.70.

Hong Kong’s Hang Seng lost 1.7 percent to 22,813.22, while the Shanghai Composite index edged 0.2 percent lower to 3,342.01.

The announcement came as a “major shock,” Yeap Junrong of IG said in a commentary.

“China, in particular, was hit with an additional 34 percent tariff, bringing its total tariff burden to 64 percent when accounting for previous measures.”

However, losses were partly blunted by expectations of further economic stimulus from Beijing to offset the impact of the higher tariffs.

In Australia, the S&P/ASX 200 fell 0.9 percent to 7,859.70.

Bangkok’s SET shed 1.1 percent after Thailand was assigned a 36-percent tariff on its exports to the US.

That could cause Thai exports to fall by $7 billion to $8 billion, or about 2.3 percent of the total, Kasem Prunratanamala of CGS International said in a report.

On Wednesday, U.S. stocks whipped through another dizzying day before Trump’s unveiling of his “Liberation Day” tariffs.

The S&P 500 rose 0.7 percent to 5,670.97 after careening between an earlier loss of 1.1 percent and a later gain of 1.1 percent. It’s had a pattern this week of opening with sharp drops only to finish the day higher.

Your subscription could not be saved. Please try again.

Your subscription has been successful.

The Dow industrials added 0.6 percent to 42,225.32, and the Nasdaq composite climbed 0.9 percent to 17,601.05. With a report from AP