Fast fashion giant Shein is asking some of its top apparel suppliers in China to set up new production capacity in Vietnam with incentives including higher procurement prices of as much as 30 percent, people familiar with the matter said.

The efforts have been in the works for the past few months and have accelerated in recent weeks as the company seeks to mitigate the impact of fresh US tariffs on Chinese goods, the people said, asking not to be identified discussing private conversations.

Adding supply outside of China will allow Shein to avoid President Donald Trump’s punitive policy on goods coming from the world’s second-largest economy. This includes the removal of a longstanding duty-free exception for low-value packages, which poses an existential problem for Shein and rival Temu, whose businesses are built on the so-called “de minimis” rule.

The sweeteners that Shein is offering its top Chinese suppliers to open new production lines in Vietnam include higher procurement prices of 15-30 percent and guaranteeing bigger orders, the people said. It is also accepting a longer production timeline and will help with building the facilities and transporting fabric from China to Vietnam, they added.

But these incentives will only cover the first months of a suppliers’ set-up and are not permanent, the people said. It’s also unclear if suppliers will scale down their existing China capacity after setting up plants in Vietnam. Discussions are at an initial stage and plans could still change.

A Shein spokesperson denied via email that the company plans to add production capacity in Vietnam, without elaborating.

The company’s strategy reflects how Trump’s tariff blitz could disrupt future production in China, threatening parts of its vast manufacturing sector and putting jobs at risk. The new US tariffs will cut China’s total export growth by 1.3 percentage points and reduce its gross domestic product expansion this year by 0.2 percentage point, Nomura Holdings Inc. economists said last week.

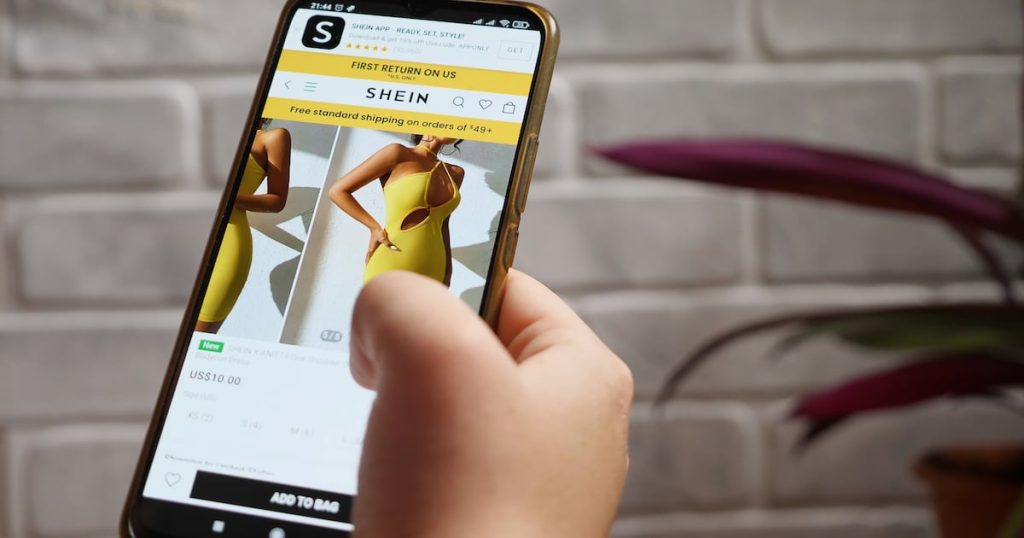

A pioneer of ultra-fast fashion with items such as shirts and swimsuits for as little as $2, Shein filed for a US IPO last year aiming for a valuation of $80 billion to $90 billion, people familiar with the matter said at the time. Private trades in late 2023 valued the company much lower, at about $50 billion, and Shein is now said to be working on listing in London instead.

While it has set up supply lines in places like Brazil and Turkey in the past few years, the bulk of the brand’s fast-turnaround operation is still in mainland China.

Trump’s new tariffs on China have been mired in chaos. After the removal of the “de minimis” rule kicked in last week, the US Postal Service at first said it would no longer accept inbound packages from China and Hong Kong, only to reverse its position less than a day later.

The US president then said on Saturday that the removal of the duty-free exemption would be delayed until adequate systems are in place to collect tariff revenue.

Despite the uncertainty, Shein and Temu merchants are being asked by logistic agents to prepay an extra 30 percent of the retail value of goods sold to factor in tariffs, Bloomberg reported.

Bloomberg News

Learn more:

A Death Blow for Dupe Culture, Deferred

The Trump administration this week closed – then reopened – a tax loophole that enabled Shein and Temu’s low prices.