The author has shared a Podcast.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

Subscribe to the BoF Podcast here.

Background:

“Will India be the next China?” is a question that’s circulated throughout the fashion industry for years. Even as its population and economy both surge, India’s cultural tapestry and fragmented retail landscape set it apart from its northern neighbour.

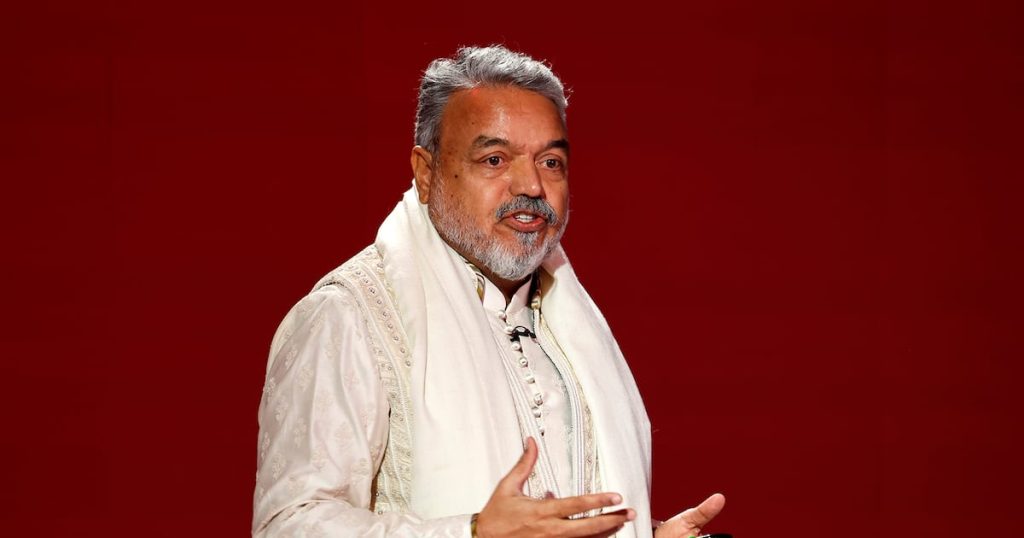

At BoF VOICES 2024, Ravi Thakran drew on his experiences pioneering luxury growth for Swatch in 1990s China and leadership of LVMH in Asia to share his unique insights on the many differences between the world’s two most populous countries, and why European luxury brands have not yet managed to really crack the Indian market.

“India is now across China and growing faster. But when it comes to the luxury market — talk of any brand, be it Mercedes-Benz, BMW, Louis Vuitton, Cartier — India is less than 1 percent,” says Thakran. “India’s stupendous growth is right in front of us, but the bulk of that growth is led by a very young population with a very low per capita income. So if you are an aspirational player, go to India today. This will be your biggest play going forward. In luxury, you still have to work.”

Thakran unpacks the dynamics of economic growth in India, explains why its path won’t mirror China’s, and shares insights on how to succeed in one of the world’s most complex yet promising markets.

The author has shared a YouTube video.You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

Key Insights:

- From garments to accessories, Asia has scaled production to supply most of the global market. Simultaneously, it’s also the top consumer region for many categories, making Asia pivotal in both supply and demand equations. Despite this, its share of value in these categories remains low: “Asia is now the largest market of the world and across [garments, accessories and watches], more than 50 percent. … How come its share of value in these categories is so low?” queries Thakran. “Value resides in brands. And where do these brands live? The brands today for these categories are still in Europe and the USA.”

- While India’s market is huge, it is fragmented and complex. Challenges for fashion brands include high import duties, limited retail infrastructure and a deeply rooted tradition of local attire. Western brands need to adapt to India’s cultural context if they hope to gain traction. “LVMH is not a luxury enough for India … Indian luxury will always remain very Indian. Unless you Indianise, you’re unlikely to crack that market,” says Thakran.

- Drawing on teachings from Buddah and Gandhi, Ravi underscores that Asia’s rising wealth need not translate into mindless consumption. Gandhi’s simple lifestyle and the Buddha’s teachings on desires offer a philosophical counterbalance that resonates in today’s sustainability-conscious world. “While we are trying to make India adapt to the West, I think there is a message for the West to adopt from India,” says Thakran.